-

2026 Spatial Industry Transformation and Growth AgendaThis Agenda and its complementary plan has been in operation for three years. It comprises over 30 key initiatives to grow the spatial industry built up from a comprehensive, nation-wide program of consultation. Industry-led by SIBA|GITA, the 2026 Agenda is governed by a Leadership Group that equally comprises spatial industry leaders and leaders from key end-user industries. The 2026 Agenda represents a well-established program with substantial momentum that will be readily rolled into the 2030 RoadMap.

2026 Spatial Industry Transformation and Growth AgendaThis Agenda and its complementary plan has been in operation for three years. It comprises over 30 key initiatives to grow the spatial industry built up from a comprehensive, nation-wide program of consultation. Industry-led by SIBA|GITA, the 2026 Agenda is governed by a Leadership Group that equally comprises spatial industry leaders and leaders from key end-user industries. The 2026 Agenda represents a well-established program with substantial momentum that will be readily rolled into the 2030 RoadMap. -

Academies National Science InitiativesThe two science academies, the Australian Academy of Science and the Australian Academy of Technology and Engineering, are currently developing a national space science strategy that has a number of elements including; capacity development, communications technologies, demographics, education and training, planetary sciences, remote sensing and PNT, space health and life sciences, space situational awareness &space weather, space technology, and the heliosphere. The 2030 RoadMap will augment these planning efforts.

Academies National Science InitiativesThe two science academies, the Australian Academy of Science and the Australian Academy of Technology and Engineering, are currently developing a national space science strategy that has a number of elements including; capacity development, communications technologies, demographics, education and training, planetary sciences, remote sensing and PNT, space health and life sciences, space situational awareness &space weather, space technology, and the heliosphere. The 2030 RoadMap will augment these planning efforts. -

ANZLIC – the peak spatial data policy Council for Government in Australia and New ZealandFaces a threshold point on harnessing the spatial digital twin as the next step-change in spatial data infrastructure (SDI) thinking and practice. In March 2020, ANZLIC published its Strategic Plan 2020-24 and is poised to participate in the 2030 RoadMap.

ANZLIC – the peak spatial data policy Council for Government in Australia and New ZealandFaces a threshold point on harnessing the spatial digital twin as the next step-change in spatial data infrastructure (SDI) thinking and practice. In March 2020, ANZLIC published its Strategic Plan 2020-24 and is poised to participate in the 2030 RoadMap. -

Australia-UK Space BridgeIn September the Australian and the United Kingdom announced the new Australia – UK Space Bridge designed to enable the nation’s space businesses better access to the global space sector. The Bridge will facilitate new trade and investment opportunities and the exchange of knowledge and ideas. The 2030 RoadMap will strengthen Australia’s ability to leverage this and other international agreements which already exist or will come into being in the future.

Australia-UK Space BridgeIn September the Australian and the United Kingdom announced the new Australia – UK Space Bridge designed to enable the nation’s space businesses better access to the global space sector. The Bridge will facilitate new trade and investment opportunities and the exchange of knowledge and ideas. The 2030 RoadMap will strengthen Australia’s ability to leverage this and other international agreements which already exist or will come into being in the future. -

The Australian Space Agency (ASA)Established in June 2018, ensures Australia has a peak agency for space responsible for achieving the economic growth targets. The ASA developed the Australian Civil Space Strategy to advance this vision and provide a long-term plan for the space sector.

The Australian Space Agency (ASA)Established in June 2018, ensures Australia has a peak agency for space responsible for achieving the economic growth targets. The ASA developed the Australian Civil Space Strategy to advance this vision and provide a long-term plan for the space sector. -

Capacity Building – STEMThe nation is facing a growing shortage of STEM skilled workers. A vital requirement is an expansion of the capacity of the education sector across all the space and spatial disciplines to fulfil the skillset needs for under-graduate, post-graduate, to vocational and micro-credentialing.

Capacity Building – STEMThe nation is facing a growing shortage of STEM skilled workers. A vital requirement is an expansion of the capacity of the education sector across all the space and spatial disciplines to fulfil the skillset needs for under-graduate, post-graduate, to vocational and micro-credentialing. -

Circular EconomyA circular economy is based on the principles of designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. Spatial information can be an enabler of circular economy activity in cities in the same way it is used for land use planning as waste is produced at a location and will travel to a location for processing and reuse as part of a circular economy.

Circular EconomyA circular economy is based on the principles of designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. Spatial information can be an enabler of circular economy activity in cities in the same way it is used for land use planning as waste is produced at a location and will travel to a location for processing and reuse as part of a circular economy. -

COVID-19 RecoveryAs the nation prepares for the recovery phase of its battle with COVID-19 the timing of the road-mapping represents an ideal opportunity to develop a deep and well considered contribution to the national planning, especially its ability to engender confidence and hope for a challenged private sector.

COVID-19 RecoveryAs the nation prepares for the recovery phase of its battle with COVID-19 the timing of the road-mapping represents an ideal opportunity to develop a deep and well considered contribution to the national planning, especially its ability to engender confidence and hope for a challenged private sector. -

CSIROIs growing its capability in space, building on its long history in spacecraft tracking and earth observation. The Space Technology Future Science Platform funds technology development across all of CSIRO’s business areas, including advanced manufacturing, agriculture and biosciences. CSIRO has also purchased 10% of time on the NovaSAR earth observation satellite, which will be available to Australian researchers as a national facility.

CSIROIs growing its capability in space, building on its long history in spacecraft tracking and earth observation. The Space Technology Future Science Platform funds technology development across all of CSIRO’s business areas, including advanced manufacturing, agriculture and biosciences. CSIRO has also purchased 10% of time on the NovaSAR earth observation satellite, which will be available to Australian researchers as a national facility. -

The Department of DefenceThe July publication of 2020 Defence Strategic Update and Force Structure Plan commits Defence to $7B of space investment and foreshadows up to $13.4B in the longer term. It is perfect timing now to marry this with the road-mapping of the civilian sector and recognise a key objective of the Department of Defence which is to improve Australia’s defence resilience and develop a competitive and sustainable Defence industrial base.

The Department of DefenceThe July publication of 2020 Defence Strategic Update and Force Structure Plan commits Defence to $7B of space investment and foreshadows up to $13.4B in the longer term. It is perfect timing now to marry this with the road-mapping of the civilian sector and recognise a key objective of the Department of Defence which is to improve Australia’s defence resilience and develop a competitive and sustainable Defence industrial base. -

Earth Observation Australia (EOA) IncIs Australia’s peak body representing industry, all levels of government, research and education, that collect and transform earth observation data into essential products and services for government, defence and industry.

Earth Observation Australia (EOA) IncIs Australia’s peak body representing industry, all levels of government, research and education, that collect and transform earth observation data into essential products and services for government, defence and industry. -

Emergency Response to Natural HazardsAn effect of climate change is increased frequency and severity of natural hazards including but not limited to bushfire, floods, cyclones and drought. The need to predict, prepare, respond and recover from these natural hazards will be a critical element of national resilience. Space and spatial technologies and capabilities are poised to play a central role in equipping the nation to address this challenge.

Emergency Response to Natural HazardsAn effect of climate change is increased frequency and severity of natural hazards including but not limited to bushfire, floods, cyclones and drought. The need to predict, prepare, respond and recover from these natural hazards will be a critical element of national resilience. Space and spatial technologies and capabilities are poised to play a central role in equipping the nation to address this challenge. -

Geoscience Australia (GA)Is leading the development of high-accuracy Positioning, Navigation and Timing (PNT) infrastructure for Australia with a $225M investment from the Australian Government in the 2018 budget. GA is also pioneering the use of satellite imagery data through the DEA capability, with an initial investment of $37m and a further ongoing investment of approximately $12M per year, providing a powerful capability for harnessing the enormous data stores of satellite imagery

Geoscience Australia (GA)Is leading the development of high-accuracy Positioning, Navigation and Timing (PNT) infrastructure for Australia with a $225M investment from the Australian Government in the 2018 budget. GA is also pioneering the use of satellite imagery data through the DEA capability, with an initial investment of $37m and a further ongoing investment of approximately $12M per year, providing a powerful capability for harnessing the enormous data stores of satellite imagery -

Interconnected national systems for greater resilienceThe Government has increased Australia’s national focus on protecting critical infrastructure and systems of national significance. This aims to identify and understand the vulnerabilities of our society arising from interconnected and interdependent critical infrastructure, much of which is owned by commercial organisations whose business models rely on the interconnected global economy.

Interconnected national systems for greater resilienceThe Government has increased Australia’s national focus on protecting critical infrastructure and systems of national significance. This aims to identify and understand the vulnerabilities of our society arising from interconnected and interdependent critical infrastructure, much of which is owned by commercial organisations whose business models rely on the interconnected global economy. -

Low-Carbon EconomyThe global effort to counter climate change requires governments and societies to transition to low-carbon economies. This will force change through many sectors including energy, transport, agriculture, mining and others.

Low-Carbon EconomyThe global effort to counter climate change requires governments and societies to transition to low-carbon economies. This will force change through many sectors including energy, transport, agriculture, mining and others. -

NASAIn September the Prime Minister announced a $150M contribution to support Australian involvement in NASA’s Moon and Mars shots (the Lunar Gateway and Project Artemis). This investment will support Australian businesses contribute to NASA’s critical pipeline of work. Australia was also an early signatory of the NASA sponsored Artemis Accord which define a set of principles guiding the exploration of outer space.

NASAIn September the Prime Minister announced a $150M contribution to support Australian involvement in NASA’s Moon and Mars shots (the Lunar Gateway and Project Artemis). This investment will support Australian businesses contribute to NASA’s critical pipeline of work. Australia was also an early signatory of the NASA sponsored Artemis Accord which define a set of principles guiding the exploration of outer space. -

National Space Growth ObjectivesThe Australian Government is committed to achieving two key objectives for the space industry by 2030: 1) 20,000 additional jobs and, 2) triple the size of the space economy to a $12 billion contribution to GDP. The current size of the Australian space industry is around $3.9 billion. The Roadmap will specifically address these key national goals.

National Space Growth ObjectivesThe Australian Government is committed to achieving two key objectives for the space industry by 2030: 1) 20,000 additional jobs and, 2) triple the size of the space economy to a $12 billion contribution to GDP. The current size of the Australian space industry is around $3.9 billion. The Roadmap will specifically address these key national goals. -

Open Geospatial Consortium in AustraliaMany members of OGC come from Australia. Multiple OGC international meetings have been hosted by Australia. Australian members have led or contributed to the establishment of several OGC Standards. The Australia and New Zealand Forum provides a community for discussing issues particular to the region.

Open Geospatial Consortium in AustraliaMany members of OGC come from Australia. Multiple OGC international meetings have been hosted by Australia. Australian members have led or contributed to the establishment of several OGC Standards. The Australia and New Zealand Forum provides a community for discussing issues particular to the region. -

Peak Industry BodiesAustralia’s peak space industry body, the Space Industry Association of Australia (SIAA), and peak spatial industry body, the Spatial Industries Business Association and Geospatial Information & Technology Association ANZ (collectively known as SIBA|GITA) have a nascent collaboration at present. The 2030 RoadMap will provide the mechanism for formalising a new era of close cooperation between the two industry peak bodies.

Peak Industry BodiesAustralia’s peak space industry body, the Space Industry Association of Australia (SIAA), and peak spatial industry body, the Spatial Industries Business Association and Geospatial Information & Technology Association ANZ (collectively known as SIBA|GITA) have a nascent collaboration at present. The 2030 RoadMap will provide the mechanism for formalising a new era of close cooperation between the two industry peak bodies. -

The recently created SmartSatCRCIs set to invest $245 million in space technologies over the next seven years through its 100 plus partnering organisations which include 70 companies, 20 universities and the CSIRO, and the Department of Defence through DST. The SmartSatCRC’s strategic plan will benefit greatly if it can be nested in the context of the proposed 2030 RoadMap.

The recently created SmartSatCRCIs set to invest $245 million in space technologies over the next seven years through its 100 plus partnering organisations which include 70 companies, 20 universities and the CSIRO, and the Department of Defence through DST. The SmartSatCRC’s strategic plan will benefit greatly if it can be nested in the context of the proposed 2030 RoadMap. -

SovereigntyOne of the fundamental motivations for the reinvigoration of Australia’s space policy and space industry has been the recognition that Australia needs far more sovereign equity in and assured access to vital space assets and space-derived services. Achieving of this objective will be greatly aided by the RoadMap which will collectively steward harmonised policy, planning and investment for Australian partnership in and ownership of space assets and spatial data and services.

SovereigntyOne of the fundamental motivations for the reinvigoration of Australia’s space policy and space industry has been the recognition that Australia needs far more sovereign equity in and assured access to vital space assets and space-derived services. Achieving of this objective will be greatly aided by the RoadMap which will collectively steward harmonised policy, planning and investment for Australian partnership in and ownership of space assets and spatial data and services. -

Surveying & Spatial Sciences Institute (SSSI)Is the national peak body catering for the 2200 professionals who make up the spatial information industry. SSSI gives a voice to the members of the spatial science community in both the national and international arena. SSSI through its Remote Sensing Commission is heavily involved in utilising earth observation data and has an active community of practice within the professionals.

Surveying & Spatial Sciences Institute (SSSI)Is the national peak body catering for the 2200 professionals who make up the spatial information industry. SSSI gives a voice to the members of the spatial science community in both the national and international arena. SSSI through its Remote Sensing Commission is heavily involved in utilising earth observation data and has an active community of practice within the professionals. -

The Spatial IndustryHas critical capabilities that leverages space technologies, both for earth observation and positioning, providing high value information products and services to almost every part of the Australian economy. This critical capability is set for significant growth over the next decade, delivering whole new application capabilities and service areas.

The Spatial IndustryHas critical capabilities that leverages space technologies, both for earth observation and positioning, providing high value information products and services to almost every part of the Australian economy. This critical capability is set for significant growth over the next decade, delivering whole new application capabilities and service areas. -

Value of the spatial industryAustralia’s spatial industry currently contributes at least $12 billion to GDP. The Spatial Industry is growing at around 10% globally and is set to make a major contribution to the achievement of the ASA’s space industry growth objectives.

Value of the spatial industryAustralia’s spatial industry currently contributes at least $12 billion to GDP. The Spatial Industry is growing at around 10% globally and is set to make a major contribution to the achievement of the ASA’s space industry growth objectives.

AN INDUSTRY ROADMAP

Read the Space + Spatial Industry Roadmap

Roadmap: Executive Summary

Roadmap: Full document

Roadmap drivers

Australia’s space sovereignty

Delivery of space-enabled services depends on reliable and continued access to satellite systems and their data streams. With some minor exceptions Australia does not have a history of ownership of satellites and systems. Instead, the national focus has been on exploitation of the systems of other nations or organisations through a globally well-regarded approach to collaboration.

Characterised by a multi-source approach, Australia has developed applications that integrate different types of data from different suppliers and partners with the benefit that:

- the applications are richer (e.g. by exploiting the strengths of different systems in a complementary manner, or using multiple systems to provide additional data to increase spatial and temporal coverage); and

- Australia is more insulated from technical failures (e.g. instrument failure) or sudden changes in the policy environment (e.g. sudden changes to data policy).

Australia is likely to continue to build on this approach to enable the delivery of better products to users and consumers locally, and globally. Moreover, Australia’s openness to using what is available is not just of interest to Australia, but also to the approximately 170 or so other nations who would prefer not to be dependent on data controlled by a single major supplier. Continued encouragement of the multi-source approach positions Australia well to export space-enabled services.

However, Australia must also consider how to better manage the risks associated with dependence on other nations and foreign companies. Continued and increased investment in ground segment partnerships will continue to be a key part of generating goodwill. Australia is keen to continue to encourage global coordination of satellite systems, the use of standards and ‘open public data’. This approach has given Australia access to a richer diversity of data types than would be available under an uncoordinated approach with every nation focussed only on unilateral outcomes.

Australia’s space industry could, however, play an important role in developing niche capabilities and systems that address key risks and opportunities. This capability should be developed, and then leveraged, to address scenarios where Australia:

- has something of value to contribute to the space segment of critical partner programs (in return for assurance of future data supply).

- has unique local or regional needs, that are highly unlikely to be met internationally.

- can support users to strengthen the ‘multi-source’ approach, for example by providing cross-calibration of foreign missions.

- can make contributions to the global observing system, and thereby encourage ongoing coordination and data sharing by others.

- can identify risks where sovereign access or control can reduce our exposure to an acceptable level.

- can obtain timely access to data, as one component of assurance, that contributes to high priority national needs

Developing and nurturing our nascent space industry’s capabilities to meet these needs in any operational (as opposed to experimental) sense will take time. It will need support and encouragement from government, including to ensure our industry has the necessary maturity and technical readiness. Australia has highly trained people, and many innovative businesses.

However, many of the satellite systems Australia relies upon for the data that underpins spatial services are highly sophisticated with a proven record for operational reliability.

Although changes in satellite technology do lower barriers and create new opportunities, a clear-eyed approach, responding to requirements and drivers in the market, will be needed when considering the development of national missions.

Defining Australian Space and Spatial Sovereignty

There has been increasing use of the term sovereignty and concern about supply chain vulnerability in relation to the space sector by Government in recent times. Major legislative and policy announcements such as the Security Legislation Amendment (Critical Infrastructure) bill, the Modern Manufacturing initiative and the Defence Strategic Update all make reference to a need for sovereignty and reduced reliance on global supply chains for critical infrastructure, systems and technology including space.

It would be useful to derive an agreed definition of ‘sovereignty and the national need’ in the context of access to Australian space and spatial services.

A working definition of sovereignty and the national interest would address the required degree to which Australia is capable of determining and prosecuting actions deemed by Government to be in our national interest; free of interference, coercion or limits imposed by other nations.

This might include access to, and the operation of, the space systems themselves, or to intellectual property allowing effective operation of the system in question.

Sovereignty and the national need might be implied to infer requirements for ownership and /or control from Australian legal entities or from within Australian geography. Within the space and spatial sector, this could extend to the industrial capability that supplies goods and services and ownership/control of supply chains upon which acquisition, operation and sustainment of all components of the enterprise depend, and the skillsets and capability in the workforce, the research sector and the public service.

Interference, coercion and limits might result in constraints on what space services Australia can access. It may also be observed as degradation of available services if Australia’s interests do not align with the interest of the supplying organisation or their host nation.

For example, an imagery provider may not support request for data over certain geographic areas or a government operator of a GNSS system may degrade or turn off a timing signal for a certain time or over a certain geographic area. A communications service provider may not, or may not be able to, provide coverage or limit available RF bandwidth at certain times or over certain locations.

The following diagram shows how procurement strategies might recognise when such controls could hinder our freedom of action and drive the need for national self-reliance or sovereignty.

In the section about Space & Spatial and this section about related industry agendas, much is detailed around the emerging changes facing us as we move towards 2030. The questions we are inviting you to answer will be framed slightly differently for varying perspectives:

Risk Analysis

The Space Cross-sectoral Interest Group, which is part of the Trusted Information Sharing Network of Australia’s Critical Infrastructure Advisory Council is undertaking a detailed analysis of the risks and dependencies

faced by Australia’s reliance on space assets (Satellite communications; PNT; and earth observation) in every area of Australia’s critical infrastructure (including but not limited to health, food and agriculture, banking and finance, transport, water services, communications and energy). Critical infrastructure in the Australian context includes not just the tangible assets but also the information supply chains on which they critically rely. This work, by its very nature, marries the space segments with the information supply chains, many of which carry vital spatial

information to end users. Its success will rely on a close working relationship between space and spatial and which will feed into the deliberations of the RoadMap, especially the elements that address Australia’s vulnerabilities and the essential actions to improve our resilience to threats.

The analysis of threats and dependences include an examination of the full supply chain for each of the critical dependencies. The analysis is based on the international risk standard ISO 31,000:2018. A risk matrix is being developed comprising the threat, risk description, the potential impact, the risk owner, the existing controls, the risk rating, the current monitoring strategies, the current risk treatments, and the residual risk rating.

Importantly the analysis will identify principal risks that represent an unacceptably high residual risk. These will be gathered up in a principal risks register that will form the basis of further analysis that will dimension and propose additional treatments and controls. Additional actions required will then be considered for inclusion in the 2030 RoadMap.

As part of the Risk Assessment, an initial focus will be the on the impact of outages on critical infrastructure and services of national significance related to GNSS. A number of international reports are being reviewed to analyse the vulnerabilities inherent with PNT as provided by GNSS. At the core of this initial activity is a plan to document levels of dependence on PNT in a highly constrained scenario, a major metropolitan centre and the impact on a narrow section of the economy. This does not aim to identify threats or economic impact but rather focus on the scale of the problem and the associated dependencies and interdependencies between the identified sector (most likely transport and logistics) and space-based GNSS services.

Note this would be a technology/technical focused study, not an economic study.

Firstly, a Use case study would be carried out to identify critical and significant elements of the integrated transport and logistics sector for a capital city, which currently utilises satellite-based GNSS systems. It would also estimate the high-level impacts on the local, regional and national operations in these sectors, should access to space systems be lost for various periods of time.

Secondly, using the results from the above Case study, a framework would be created that would allow for a deeper dive into what is needed to improve the resilience of critical infrastructure, namely to mitigate the effects and impacts of outages. It is also considered to develop feedback that would be shared with the TISN and other groups responsible for maintaining industrial productivity.

Risks and Hazards

A hazard may be defined as “a situation or thing that has the potential to cause damage or harm”. The international risk standard defines risk as the “effect of uncertainty on objectives – and an effect is a positive or negative deviation from what is expected”. A risk is the probability that exposure to a hazard will result in harm or damage. The table below lists indicative hazards potentially affecting space based systems.

List of Space Hazards

Industry snapshot

The space industry has been estimated to be worth US$350 billion in 2019 with potential to grow to over $US1.1 trillion by 2040. The Australian space sector is estimated to be around $3.9 billion in size in 2019 and forecast to grow at 7.1% pa over the five years to 2024.

The total direct economic benefits from the use and application of earth observation from space data alone was found to be worth A$496 million to the Australian economy in 2015 , and predicted to reach A$1,694 million by 2025. In 2016, geospatial services were conservatively estimated to generate US$400 billion per year globally.

However, the total economic contribution was predicted to be several times higher, through approximately US$550 billion derived from consumer benefits; the creation of approximately 4 million direct and 8 million indirect jobs; and improvements of revenues and costs of sectors that contribute 75% of global GDP.

According to analysis from the leading satellite service market research company NSR, the emerging market for data analytics services on earth observation and satellite communication enabled sensor data is likely to grow rapidly as shown in Figure 1.

NSR make the observation that while the mainstay of the satellite “data” industry focused primarily on data feeds, the value of insights derived from pixels and bits has gained more importance over the years. Cloud computing has eased barriers to entry in this market, and customer adoption has increased. Leveraging services from cloud service providers and other major tech platforms for automation and machine learning tools combined with geospatial know-how has led to the growth of a highly fragmented downstream analytics market.

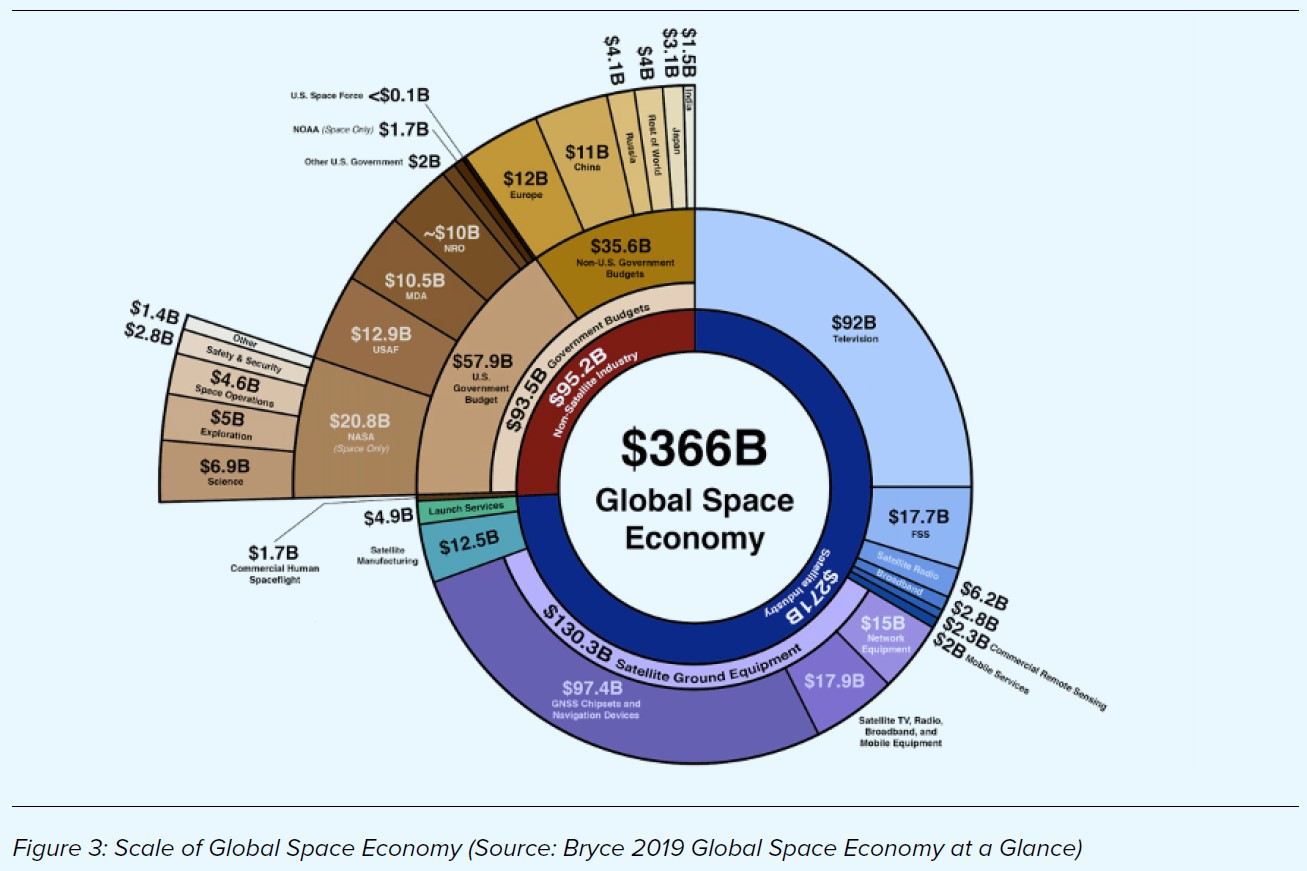

By comparison, a number of organisation work to capture global impact and value from the space and spatial markets. Two widely referenced works are shown in Figure 2 (above) and Figure 3 (below).

According to a 2018 UK Cabinet Office economic analysis, more accessible and better-quality location data in infrastructure and construction could be worth over £4 billion per year to the UK’s economy . In 2019, the value of Earth and Marine Observations to the 21 economies of the Asia Pacific Economic Cooperation was conservatively estimated to be US$372 billion. Under a business-as-usual model, the total estimated value of Earth observations to the Asia-Pacific is expected to reach US$1.35 trillion by 2030, or through enhanced cooperation, to exceed US$1.48 trillion . And, the Location Intelligence industry market size has grown from nearly US$ 9 billion in 2014 to around US $22 billion in 2018. The economic drivers for space and spatial are clear.

The power of the integration of space and spatial for social, environmental and economic benefits are numerous and can provide benefits across the supply chain. Think about your next cup of coffee – go all the way back to where it begins. Imagine the farm of the future … where livestock are fitted with location and health sensors that detect not just where they are but how they are coping during times of drought – all enabled through a suite of low-cost, internet connected IoT sensors. Consider that farmers are using fenceless technologies and advanced AI to develop and implement an automated sustainable grazing plan for the property that leverages where the water and feed are today and environmental forecasts to predict where it will be in the future. The milk from the cattle is associated with a sustainable farming certification through an automated farm practice monitoring and certification service based on long-term satellite data. The milk is transported from the farm to the processing factory to the café using a fleet of autonomous trucks whose routes are determined through a network analysis applied to data from a rich network of sensors from other vehicles, sensors in roads, and all enabled by highly accurate positioning, earth observations and spatial data.

From autonomous vehicles on mine sites to spatially enabled canes assisting the visually impaired to navigate smart cities, the case for the power of space and spatial integration is clear. Nations can use location to connect data and supply chains in a way that improves the safety, health, economy, and sustainability of their communities — ultimately making them more liveable and resulting in benefits to society, the economy, and the environment.

Investing in Australia’s Future Capabilities

In recognition of the current and future potential of space and spatial services to support the Australian economy and society, the government has made major infrastructure investments including the Positioning Australia Program and DEA. They have also established a national agency to drive industry growth and space coordination, the Australian Space Agency. These developments will position Australia well to harness the growing potential of space and spatial, including driven by the exponential rate of technological development.

The 2018-2019 Australian Government Budget allocated $225 million for better positioning systems for Australia. The Positioning Australia program, led by Geoscience Australia, will be delivered in partnership with New Zealand (Land Information New Zealand (LINZ)). The program is being delivered by: establishing a national network ground stations (multi-GNSS reference stations) that will track, verify and optimise data for precise positioning across Australia – known as the NPIC; and, a system to deliver corrected positioning signals directly via satellite technology through an Australian Satellite-Based Augmentation System (SBAS), which will overcome the current gaps in mobile and radio communications. SBAS augments and corrects GNSS signals to improve the accuracy of positioning data and makes it available across Australia and its maritime zones without the need for mobile phone or internet coverage. Current technology typically allows for positioning within 5-10 metre accuracy, but through the Positioning Australia program, accuracy will be improved to within three centimetres in areas with mobile phone coverage and ten centimetres everywhere else. This will deliver accurate, reliable and instantaneous positioning across Australia and its maritime zones.

The same Budget announced an ongoing investment of approximately $13 million a year to unlock the power of earth observation data for all Australians. The DEA Program translates over 30 years of satellite imagery into evidence of how Australia’s land, vegetation, and waterbodies have changed over time.

DEA provides Australian businesses and governments a snapshot of the entire Australian landscape every five days, providing detail about water availability, the development of regions and cities, and the productivity of our land. DEA provides Australian businesses with access to free and open satellite imagery, enabling the development of products that improve productivity and sustainability. DEA reduces up-front costs for businesses, allowing them to focus on innovation and value adding for their customers. DEA also enables the Australian Government to use satellite data to support decision-making in areas such as agricultural productivity, water availability, land use and management. For example, in 2019-20 DEA and the NSW Government collaborated to identify water seen over the past 30 years in almost 300,000 waterbodies across Australia, enabling government and industry alike to better understand trends and ultimately work towards their productivity and sustainability goals.

In 2019, Australia was ranked 15th globally in The Country Geospatial Readiness Index, rising from 17th place in 2017, and was recognised both as a regional leader in the Asia Pacific and as one of several “challengers” to established geospatial capability world leaders . Going forward, continued investment in Australia’s capabilities and taking fuller advantage of the space-spatial nexus by supporting this area to “scale up” its integration will see Australia’s international rank rise even further.

In Telecommunications the two main Australian operators are Optus, a publicly listed company traded on the Singapore Stock Exchange, and NBN, a Commonwealth Company, defined as a Government Business Enterprise under the PGPA Act.

NBN has invested ~$2bn in establishing their Long Term Satellite System (LTSS) network providing broadband internet to regional, rural and remote customers. The LTSS comprises two satellites (manufactured by Space Systems Loral in California), 10 “gateway” ground stations (supplied with satellite/terrestrial interface equipment by Viasat inc.) and two network management facilities. Spacecraft operations are conducted under contract by Optus from their Belrose facility.

As of January 2021, NBN supported about 109,000 satellite customers with NSW and QLD accounting for more than 50% of these customers. They indicate 438,000 premises are ready to connect.

Optus Satellites are the major commercial satellite service provider in Australia and since its initial operations as the Government owned Aussat in 1985 , has launched a total of 10 satellites. Five of these are still active including the Defence Payload System on the C1 satellite, D1, D2, D3 and Optus 10.

In July 2020, Optus announced its next generation of geo-stationary satellite would be based on the Airbus Defence and Space OneSat platform. This new class of satellite offers all electric propulsion and fully programmable communications payload offered a potential step-change in flexibility for future Australian satellite communications services. As an example, Optus disclosed its intention to use the Optus 11 satellite to “back-haul” mobile telephony black-spots improving coverage for rural customers. Airbus also announced the ability to add additional payloads, such as SBAS, on this satellite.

In 2020 the Department of Defence published its 2020 Defence Strategic Update & Force Structure Plan (over the 2020 – 2040 timeframe). The following list presents the lower published funding envelope for all planned primary space and spatial capabilities announced with the Defence Strategic Update 2020:

- Satellite Communications ($4,600m)

- Satellite Communications Assurance ($1,700m)

- Space Domain Awareness ($1,300m)

- Terrestrial Operation in Contested Space ($1,400m)

- Satellite Imagery Capability (access) ($400m)

- Sovereign Satellite Imagery Capability ($3,200m)

- Additional Sovereign Satellite Imagery Capability ($1,200m)

In addition to the increased funding allocation the space capabilities, Defence has also heavily invested in space and spatial research and innovation activities through the Defence Innovation Hub (DIH), the Next Generation Technologies Fund, the Sovereign Industrial Capability Priorities grants and Defence Science and Technology (DST) Group research. The total funding for announced Defence projects under these and other schemes is

~$50m including large scale activities such as the Buccaneer Main Mission satellite, novel sensor technologies for Space Domain Awareness, the establishment of the AGO Analytics Lab program and a range of space technology development projects.

The Office of National Intelligence (ONI) has also seeded space innovation activities through the National Intelligence Community Satellite (NICSat) program announced in May 2020 worth $4-6 million. Whilst not publicly announced by ONI, US media reported the launch of a Spire Global Lemur satellite named Djara in November 2020 as a partnership with ONI.

There have been a number of government programs from a range of agencies also announced in recent years aimed at supporting and driving research and innovation led industry growth. Collectively these programs support development and commercialisation of a range of space and spatial technologies with the aim of building a more globally competitive industry sector whilst simultaneously contributing to Australia’s economic, social and national security

The Australian Space Agency have announced an extensive range of programs aimed at supporting niche technologies and addressing infrastructure gaps across the space sector including:

- NASA Moon to Moon – $150m over five years

- International Space Investment Initiative – $15m over three year

- Space Infrastructure Fund – $19.5m for seven projects

- Mission Control Facility ($6m)

- Robotics, Automation and AI Command and Control ($4.5m)

- Space Payload Qualification facilities ($2.5m)

- Space Manufacturing Capability ($2m)

- Space Data Analysis facilities ($1.5m)

- Tracking Facility Upgrade ($1.2m)

- Pathway to launch ($0.9m)

- Australian Space Discovery Centre – $6m

The SmartSat CRC is deploying $235 million over seven years to 2026 comprising:

- $55m funding from the CRC Program

- $12m funding from the Defence Next Generation Technology Fund

- $33m Partner contributions

- $135m in-kind contributions

SmartSat CRC is developing an integrated and collaborative research program between industry academia and government research agencies focused on communications, earth observation and intelligent satellite with cross cutting program in Artificial Intelligence and Cyber Security and Resilience. The CRC aims to build an Australian sovereign space capability through world-class research and development in space systems, technology and solutions to enhance Australia’s economic prosperity and deliver national benefit. An example of the role SmartSat CRC aims to fulfil is the recent announcement by the SA Government that SmartSat CRC will work with them to deliver a hyperspectral imaging and communications satellite in partnership with local industry to provide benefit to all South Australians.

CSIRO launched the Space Technology Future Science Platform in November 2018 to generate new space- based innovations aimed at generating significant societal benefits for Australia. The program was extended by a year in 2020 bring the total funding up to $21m. Amongst many other initiatives, this program supported CSIRO’s partnership with Surrey Satellite to gain a 10% share of access to the NovaSAR S-band Synthetic Aperture RADAR (SAR) system worth more than $10m over seven years.

Collaboration – National and International Partnerships

Enhancing the network of collaboration is vital to the space and spatial growth agenda. Collaboration unlocks innovation, builds critical mass and increases national resilience. Australia has a long history of collaboration in the national and international science community including those of space and spatial. Figure 6 depicts conceptual ecosystem of Australia’s collaboration with Space and Spatial sector.

CSIRO

CSIRO has a long and proud history of national collaboration on space and spatial sciences for industrial and public good activities going back 60 years. CSIRO Centre for Earth Observation (CCEO) is the hub for our national and international earth observation activities. CSIRO are a member of the inter-agency Committee on Earth Observation Satellites (CEOS) and an Australian delegation member to the intergovernmental Group on Earth Observation (GEO). The CCEO worked closely with Australian government partners to host the 2019 GEO Ministerial Summit. The Centre also plays a key role in our international engagement with the global EO community.

The Centre for Earth Observation’s key priorities include :

- coordinating internal communities of practice (SAR, hyperspectral, LiDAR), and liaison with domestic government

- coordinating representation (including on boards and working groups) at international fora, such as GEO and CEOS

- managing CSIRO’s requirements for satellite tasking, downlink and data distribution for the NovaSAR-1 satellite

- hosting events to facilitate research collaborations for the EO community, including Symposia and workshops

- overseeing the Cubesat technology demonstrator project, a collaboration with university and industry partners

- researching new satellite sensor and on-board processing technologies and ongoing satellite calibration/validation

Geoscience Australia

Geoscience Australia has a long history of partnerships throughout government and with the publicly funded research sector and the private sector. GA’s DE is a platform that uses spatial data and images recorded by satellites orbiting our planet to detect physical changes across Australia in unprecedented detail.

DEA prepares these vast volumes of earth observation data and makes it available to governments and industry for easy use.

GA is delivering on Digital Earth Africa (DE Africa) which is building the world’s largest operational platform for accessing and analysing decades of satellite imagery specific to Africa’s land and seas. DE Africa will translate data from the world’s free earth observation satellites into ready-to-use insights about the continent’s environmental conditions. Such insights will enable African governments, NGOs, businesses, and individuals to make more informed decisions about soil and coastal erosion, agriculture, deforestation, desertification, water quality and changes in human settlements.

The South Pacific Regional GNSS Network (SPRGN) was initiated during Phase III of the AusAID funded South Pacific Sea Level Monitoring Project (SPSLMP). The SPSLMP was developed in 1991 as an Australian Government response to concerns raised by member countries of the South Pacific Forum about the potential impacts of human induced global warming on climate and sea levels.

A Satellite-Based Augmentation System (SBAS) uses space and ground infrastructure to improve the accuracy, integrity and availability of GNSS signals needed for vertical guidance. GA in partnership with New Zealand Government is fostering research and a test bed in the Pacific region. Its aim is to monitor vertical movement of the Earth’s crust in conjunction with tidal measurements as part of the SEAFRAME network located in the South Pacific Ocean.

UN

Australia currently holds the Presidency of the United Nations Global Geospatial Information Management (UNGGIM) for Asia Pacific.

ECOSOC established the Committee of Experts as the apex intergovernmental mechanism for making joint decisions and setting directions with regard to the production, availability and use of geospatial information within national, regional and global policy frameworks.

Led by United Nations Member States, UN-GGIM aims to address global challenges regarding the use of geospatial information, including in the development agendas, and to serve as a body for global policymaking in the field of geospatial information management.

The tenth session of the United Nations Committee of Experts on Global Geospatial Information Management (UN-GGIM) was held, on 26-27 August and 4 September 2020 which announced the following initiatives which are highly related to space and spatial collaboration.

- United Nations Global Geospatial Knowledge and Innovation Centre in Deqing, China

- United Nations Global Geodetic Centre of Excellence in Bonn, Germany

- United Nations Global Service Centre of the United Nations Office on ICT (UN OICT) in Brindisi, Italy

Defence Science Technology Group

The Defence Science Technology Group has evolved and expanded its approach to collaboration, within Australia’s innovation system and with international allies.

In the most recent strategy, the Minister for Defence outlines the strategic basis for enhanced R&D collaboration across all facets of Defence capability development and operations, including space.

“In a new era of strategic competition, the Defence strategy aims to ensure our defence force is technologically superior and fully integrated into a joint Australian force to be seamlessly interoperable with our Allies and partners globally. To achieve this we need seamless collaboration with our trusted industrial base and academic partners in Australia.” (More Together)

The strategy aims to drive transformation in the way Defence partners across the national S&T enterprise in order to achieve impact through strategic research. The headline program to achieve this outcome is the Science, technology and Research Shots (STaR Shots) program which includes Resilient Multi-mission Space as one of the eight focus areas. Defence clearly states that achieving the scale of effort to deliver impact across the critical task outlined by the Minister cannot be done without collaboration.

Australian Space Agency

The Australian Space Agency sees international collaboration as a critical enabler for Australian industry. It has established MOUs with nine international partner organisations and a large number of Australian and international companies.

The Australian Civil Space Strategy 2019-2028 sees international partnerships and collaboration, especially with national space agencies, as a mechanism to “open doors” and create business opportunities for industry through contribution to large scale space missions such as the NASA led Artemis Program and the UK Space Agencies International Partnership Program.

FrontierSI

FrontierSI currently has 35 partners and its predecessor the Cooperative Research Centre for Spatial Information (CRCSI) had over 100 partnering organisations across both Australia and New Zealand.

FrontierSI has several international partnerships such as JAXA, Japanese space agency, EARSC (European Association of Remote Sensing Companies) and Copernicus (European Union’s Earth observation programme). FrontierSI has been a key player under the leadership of GA in SBAS, also partnering with the New Zealand Government.

Surveying and Spatial Sciences Institute

The Surveying and Spatial Sciences Institute, the peak Spatial Professional body in Australia has signed a Memorandum of Understanding with the International Society of Digital Earth (ISDE).

The ISDE Leadership has been instrumental in developing the Big Earth Data in Support of the Sustainable Development Goals (SDGs) (2020) . The report focuses on six SDGs including Zero Hunger (SDG 2), Clean Water and Sanitation (SDG 6), Sustainable Cities and Communities (SDG 11), Climate Action (SDG 13), Life below Water (SDG 14), and Life on Land (SDG 15).

The case studies present the use of earth observation data for developing data products, new evaluation methodologies and models to monitor progress and inform policy-making at local, national, regional, and global scales.

The SSSI’s International partnership with FIG (International Federation of Surveyors), ISPRS (International Society for Photogrammetry and Remote Sensing), OGC (Open Geospatial Consortium) and ISDE are crucial for capacity building and professional development are important components of spatial and space collaboration.